All Categories

Featured

Table of Contents

The are entire life insurance and global life insurance. The cash money value is not added to the death advantage.

After one decade, the money worth has grown to roughly $150,000. He obtains a tax-free financing of $50,000 to start a business with his sibling. The plan lending rates of interest is 6%. He repays the loan over the next 5 years. Going this path, the rate of interest he pays goes back right into his policy's cash money value rather than a banks.

The Infinite Banking Concept

The idea of Infinite Financial was produced by Nelson Nash in the 1980s. Nash was a financing specialist and follower of the Austrian institution of business economics, which advocates that the worth of goods aren't clearly the result of traditional economic structures like supply and need. Instead, people value money and goods differently based on their financial status and demands.

One of the pitfalls of standard financial, according to Nash, was high-interest rates on fundings. A lot of individuals, himself consisted of, entered into monetary difficulty due to reliance on banking organizations. As long as financial institutions established the rate of interest rates and car loan terms, people didn't have control over their own riches. Becoming your very own lender, Nash identified, would place you in control over your economic future.

Infinite Banking needs you to possess your financial future. For ambitious people, it can be the finest monetary tool ever before. Right here are the advantages of Infinite Financial: Arguably the solitary most advantageous aspect of Infinite Banking is that it improves your cash money flow.

Dividend-paying entire life insurance policy is very low danger and uses you, the insurance policy holder, a great bargain of control. The control that Infinite Banking uses can best be organized into two classifications: tax obligation benefits and possession securities.

Royal Bank Visa Infinite Avion Rewards

When you make use of whole life insurance policy for Infinite Banking, you become part of a personal agreement between you and your insurer. This privacy provides particular property defenses not located in various other financial lorries. Although these protections might differ from one state to another, they can consist of defense from asset searches and seizures, protection from reasonings and defense from lenders.

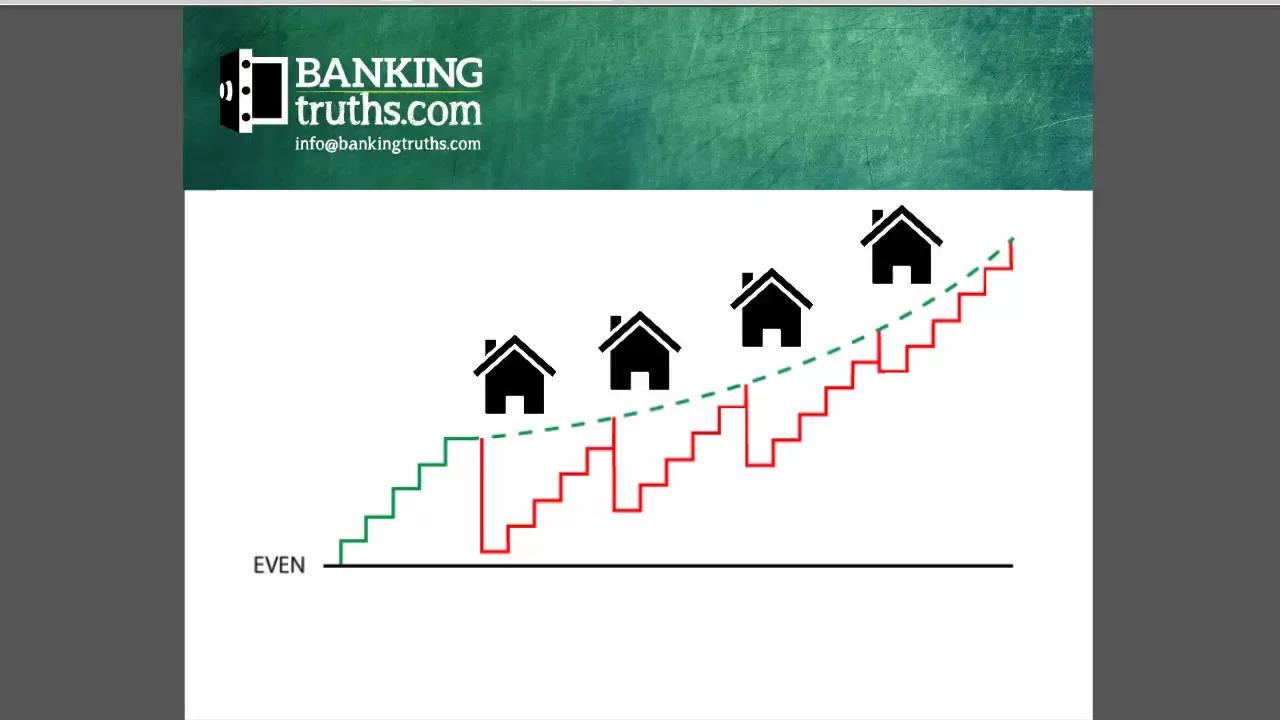

Whole life insurance policy policies are non-correlated properties. This is why they function so well as the monetary foundation of Infinite Banking. No matter what occurs in the marketplace (supply, realty, or otherwise), your insurance plan keeps its well worth. Too lots of people are missing out on this vital volatility barrier that assists safeguard and expand wealth, rather breaking their cash into 2 buckets: bank accounts and financial investments.

Market-based financial investments expand riches much quicker but are exposed to market fluctuations, making them naturally high-risk. What if there were a third pail that offered safety and security yet additionally moderate, guaranteed returns? Whole life insurance coverage is that 3rd pail. Not just is the price of return on your entire life insurance policy guaranteed, your death benefit and premiums are additionally assured.

This structure aligns completely with the concepts of the Perpetual Riches Approach. Infinite Banking interest those seeking better financial control. Here are its primary advantages: Liquidity and ease of access: Policy loans supply instant access to funds without the limitations of standard small business loan. Tax obligation performance: The cash value expands tax-deferred, and policy financings are tax-free, making it a tax-efficient tool for developing wealth.

Rbc Royal Bank Visa Infinite Avion Card

Possession protection: In many states, the money value of life insurance is safeguarded from creditors, including an added layer of financial safety and security. While Infinite Financial has its merits, it isn't a one-size-fits-all remedy, and it comes with substantial downsides. Right here's why it may not be the most effective approach: Infinite Banking typically requires detailed policy structuring, which can confuse policyholders.

Imagine never having to fret concerning financial institution fundings or high interest rates again. That's the power of limitless banking life insurance coverage.

There's no collection funding term, and you have the liberty to make a decision on the repayment routine, which can be as leisurely as paying back the loan at the time of death. This adaptability prolongs to the servicing of the financings, where you can select interest-only settlements, keeping the lending balance level and manageable.

Holding money in an IUL fixed account being credited interest can typically be better than holding the money on down payment at a bank.: You have actually constantly imagined opening your very own bakeshop. You can obtain from your IUL policy to cover the initial costs of renting out an area, acquiring devices, and employing personnel.

Infinite Banking Concept Explained

Personal financings can be obtained from standard financial institutions and credit scores unions. Obtaining money on a credit score card is usually extremely costly with annual percentage rates of passion (APR) usually getting to 20% to 30% or more a year.

The tax treatment of plan financings can vary considerably relying on your nation of residence and the certain terms of your IUL policy. In some areas, such as The United States and Canada, the United Arab Emirates, and Saudi Arabia, plan finances are generally tax-free, using a considerable advantage. Nevertheless, in other territories, there may be tax implications to consider, such as possible taxes on the finance.

Term life insurance coverage just provides a death benefit, without any type of cash money value buildup. This suggests there's no cash value to borrow against.

For finance policemans, the considerable guidelines imposed by the CFPB can be seen as troublesome and restrictive. Car loan policemans frequently suggest that the CFPB's policies create unneeded red tape, leading to even more documents and slower car loan handling. Policies like the TILA-RESPA Integrated Disclosure (TRID) policy and the Ability-to-Repay (ATR) requirements, while focused on safeguarding customers, can result in hold-ups in shutting offers and boosted functional expenses.

Latest Posts

Life Insurance - Create Your Own Bank - Prevail

Start Your Own Bank Free

Infinite Banking Review